Forex Brokers: Top-Rated Systems for Trading Success

Forex Brokers: Top-Rated Systems for Trading Success

Blog Article

Deciphering the World of Forex Trading: Revealing the Importance of Brokers in Ensuring and handling threats Success

In the detailed world of forex trading, the function of brokers stands as a crucial element that usually stays shrouded in enigma to lots of ambitious investors. The elaborate dancing in between investors and brokers introduces a cooperative connection that holds the essential to untangling the secrets of successful trading ventures.

The Role of Brokers in Foreign Exchange Trading

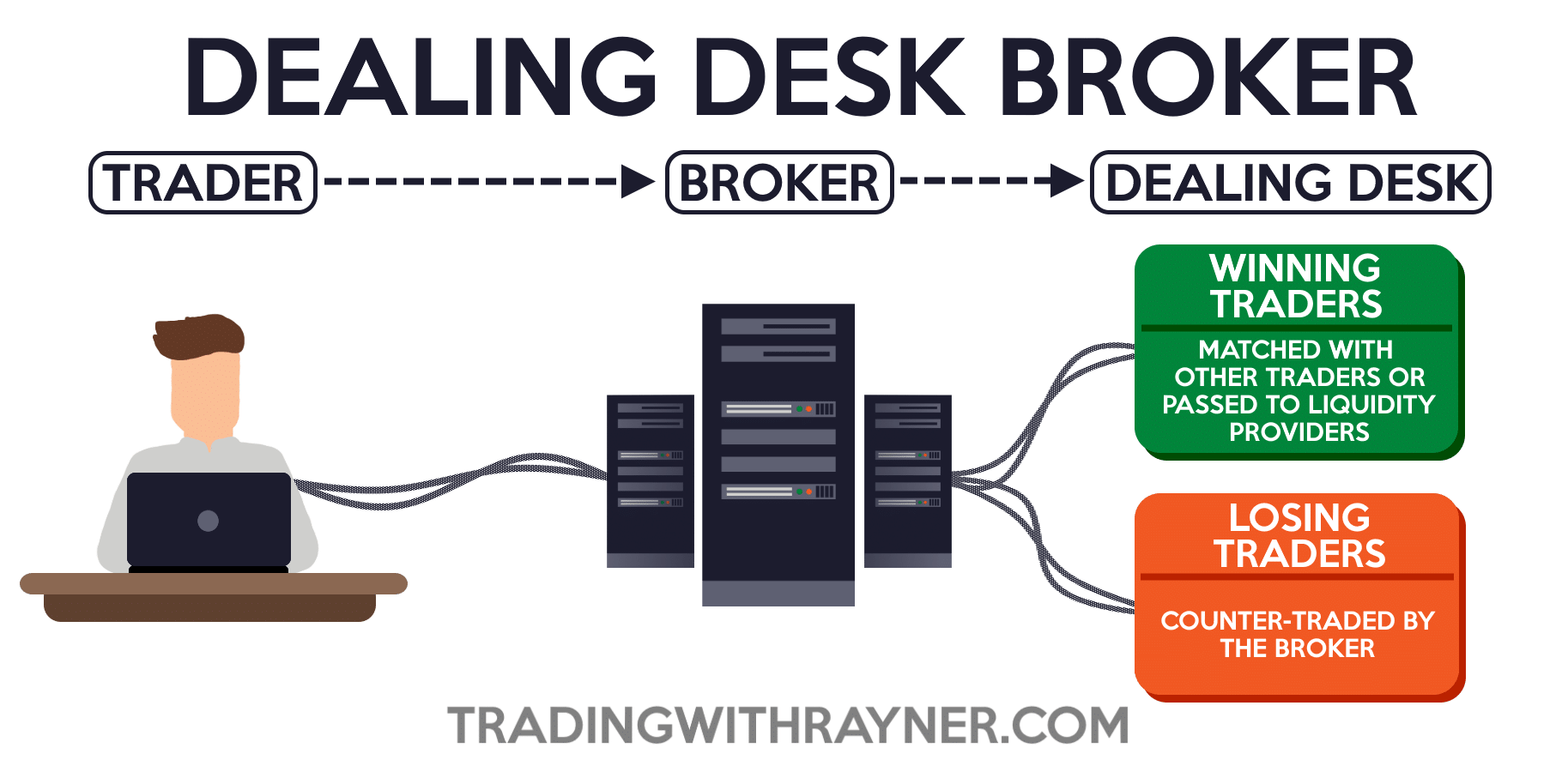

Brokers play a critical role in forex trading by supplying vital solutions that aid investors handle risks efficiently. These financial intermediaries act as a bridge in between the traders and the foreign exchange market, providing a variety of services that are vital for navigating the complexities of the fx market. Among the primary functions of brokers is to provide investors with accessibility to the marketplace by promoting the execution of professions. They offer trading systems that allow traders to deal money pairs, offering real-time market quotes and guaranteeing quick order execution.

In addition, brokers offer leverage, which makes it possible for traders to control larger placements with a smaller quantity of resources. While take advantage of can enhance earnings, it likewise raises the possibility for losses, making risk monitoring vital in forex trading. Brokers give danger monitoring tools such as stop-loss orders and limitation orders, enabling traders to establish predefined departure points to minimize losses and safe and secure revenues. Additionally, brokers use educational sources and market analysis to help traders make informed decisions and establish efficient trading approaches. Generally, brokers are essential partners for traders seeking to navigate the forex market efficiently and handle risks successfully.

Threat Management Methods With Brokers

Given the critical duty brokers play in facilitating accessibility to the foreign exchange market and offering threat administration devices, understanding efficient techniques for taking care of dangers with brokers is important for successful foreign exchange trading. One vital approach is setting stop-loss orders, which allow investors to determine the optimum quantity they agree to lose on a trade. This device helps limit prospective losses and secures versus adverse market movements. An additional vital risk management technique is diversity. By spreading out financial investments throughout various money pairs and possession classes, traders can decrease their direct exposure to any type of single market or tool. Furthermore, utilizing utilize very carefully is vital for threat monitoring. While leverage enhances earnings, it also amplifies losses, so it is essential to make use of leverage carefully and have a clear understanding of its effects. Finally, keeping a trading journal to track efficiency, evaluate past trades, and determine patterns can assist traders improve their methods and make more educated choices, ultimately improving threat management techniques in foreign exchange trading.

Broker Option for Trading Success

Selecting the right broker is extremely important for attaining success in foreign exchange trading, as it can dramatically influence the total trading experience and results. Working with a managed broker offers a layer of safety and security for traders, as it makes certain that the broker runs within set criteria and standards, hence minimizing the risk of fraudulence or malpractice.

Furthermore, investors need to assess the broker's trading platform and tools. An easy to use system with sophisticated charting tools, fast profession implementation, and a variety of order types can boost trading effectiveness. Additionally, examining the broker's consumer support solutions is important. Motivate and trusted customer support can be indispensable, particularly throughout unstable market problems or technical concerns.

Furthermore, traders ought to evaluate the broker's fee framework, consisting of spreads, compensations, and any hidden charges, to comprehend the expense effects of trading with a particular broker - forex brokers. By thoroughly assessing these aspects, traders can pick a broker that straightens with their trading objectives and establishes the phase for trading success

Leveraging Broker Expertise for Revenue

How can traders efficiently harness the know-how of their picked brokers to optimize success in foreign exchange trading? Leveraging broker proficiency commercial requires a calculated method that entails understanding and using the solutions offered by the broker to boost trading end results. One vital method to take advantage of broker competence is by benefiting from their study and evaluation tools. Many brokers offer accessibility to market insights, technical evaluation, and financial calendars, which can assist investors make notified choices. By staying notified regarding market fads and occasions via the broker's resources, investors can recognize profitable chances and alleviate dangers.

Additionally, investors can gain from the assistance and assistance of seasoned brokers. Establishing a good connection with a broker can cause customized guidance, profession recommendations, and risk management methods customized to specific trading styles and goals. By connecting frequently with their brokers and seeking input on trading methods, traders can tap into skilled understanding and enhance their general performance in the forex market. Inevitably, leveraging broker expertise commercial involves energetic involvement, continuous understanding, and a collaborative technique my blog to trading that maximizes the potential for success.

Broker Support in Market Evaluation

Additionally, brokers can provide prompt updates on economic occasions, geopolitical advancements, and various other factors that may impact money prices, making it possible for traders to remain in advance of market variations and change their trading settings appropriately. Inevitably, by making use of broker assistance in market evaluation, traders can enhance their trading efficiency and boost their possibilities of success in the affordable forex market.

Verdict

Finally, brokers play a crucial duty in foreign exchange trading by managing dangers, supplying proficiency, and assisting in market evaluation. Selecting the right broker is essential for trading success and leveraging their expertise can bring about profit. forex brokers. By making use of danger management methods and working very closely with brokers, investors can navigate the complicated world of foreign exchange trading with confidence and increase their opportunities of success

Provided the important role brokers play in helping with accessibility to the foreign exchange market and supplying threat administration tools, recognizing reliable approaches for handling threats with brokers is necessary for successful foreign exchange Check Out Your URL trading.Picking the appropriate broker is paramount for achieving success in forex trading, as it can substantially influence the general trading experience and results. Working with a regulated broker provides a layer of safety and security for investors, as it ensures that the broker runs within set guidelines and this criteria, hence minimizing the danger of fraud or negligence.

Leveraging broker knowledge for profit needs a strategic approach that includes understanding and making use of the services supplied by the broker to boost trading end results.To effectively take advantage of on broker proficiency for profit in foreign exchange trading, investors can rely on broker help in market evaluation for notified decision-making and danger reduction techniques.

Report this page